Pradhan Mantri Suraksha Bima Yojana (PMSBY) will be a one-year cover, renewable from year to year, accident insurance scheme offering accidental death and disability cover for death or disability on account of an accident. The scheme would be offered/administered through Public Sector General Insurance Companies (PSGIC) and other General Insurance companies willing to offer the product on similar terms with necessary approvals and tie up with Banks for this purpose. Participating banks will be free to engage any such insurance company for implementing the scheme for their subscribers.

In this article, we will provide you with complete information about Pradhan Mantri Suraksha Bima Yojana. Kindly look through it for PMSBY Benefits & Feature, Current Progress, News Update, Eligibility Check, Documents Required, Registration, Sign up Log in, Online Form, How to Apply, Beneficiary List, Status Check.

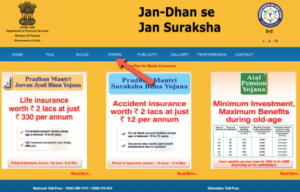

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

As you know that there are many people in the country who are unable to get their insurance because of being financially poor. At the same time, whenever such a person dies in an accident, then his entire family starts fighting financially. If a person is not able to pay for any type of insurance plans available with private or any public sector insurance companies, then they are all eligible for Pradhan Mantri Suraksha Bima Yojana. Under this scheme, if a person insures his accident and dies, then the amount that that person has insured is given as a cover to his family or nominee.

The risk coverage under the scheme is Rs. 2 lakh for accidental death and full disability and Rs. 1 lakh for partial disability. The premium of Rs. 12 per annum is to be deducted from the account holder’s bank account through the ‘auto-debit’ facility in one installment. The Pradhan Mantri Suraksha Bima Yojana is being offered by Public Sector General Insurance Companies or any other General Insurance Company who are willing to offer the product on similar terms with necessary approvals and tie-up with banks for this purpose.

प्रधान मंत्री सुरक्षा बीमा योजना (पीएमएसबीवाई) का उद्देश्य वंचित आबादी को प्रति वर्ष केवल 12 रुपये के प्रीमियम पर कवर करना है।

Pradhan Mantri Suraksha Bima Scheme Feature

- The scheme provides an annual premium of Rs. 12 per annum per member.

- This premium is auto-debited in one installment on or before 1st June of every year.

- In case of the death of the account holder, the benefits of the scheme can be availed by his/her nominee.

- A life cover of Rs. 1 lakh is provided to the beneficiary in case of partial disability.

Pradhan Mantri Suraksha Bima Yojana Key Highlights

| Name of the Schema | Pradhan Mantri Suraksha Bima Yojana (PMSBY) प्रधानमंत्री सुरक्षा बीमा योजना |

| Announced By | Hon’ble Prime Minister of India Shri Narendra Modi |

| Scheme Goal | Attempts to provide a universal social security system |

| Scheme Beneficiaries | Citizen of India |

| Application mode | Offline |

| Financial Assistance | Accidental Insurance worth Rs.2 Lacs at just Rs.12 per annum |

| Official Website | https://www.jansuraksha.gov.in/ |

PMSBY Benefits

| Table of Benefits | Sum Insurance |

|---|---|

| Death | Rs. 2 Lakh |

| Total and irrecoverable loss of both eyes or loss of use of both hands or feet or loss of sight of one eye and loss of use of hand or foot. | Rs. 2 Lakh |

| Total and irrecoverable loss of sight of one eye or loss of use of one hand or foot | Rs. 1 Lakh |

Pradhan Mantri Suraksha Bima Scheme Eligibility Criteria

- Age must be between 18 to 70 years.

- All individual (single or joint) bank account holders.

- Applicants must have an Aadhar card. These Aadhaar details will be linked with their bank account.

- He/she must have a bank account along with their phone number linked to the account.

- In the case of multiple bank accounts held by an individual in one or different banks, the person would be eligible to join the scheme through one bank account only.

Documents Required for Pradhan Mantri Suraksha Bima Yojana (PMSBY)

- Bank Account Details.

- Aadhar Card.

- Age Proof.

- Address Details.

- Basic Details.

- Phone Number.

- Email ID.

Pradhan Mantri Suraksha Bima Scheme Premium

- Insurance Premium payable to Insurance Company: Rs.12/- per annum per member.

- Reimbursement of Expenses to BC/Micro/Corporate/Agent by the insurer: Rs.1/- per annum per member.

- Reimbursement of Administrative expenses to participating Bank by the insurer: Rs.1/- per annum per member.

Termination of PMSBY cover

- Closure of account with the Bank or insufficiency of balance to keep the insurance in force.

- On attaining age 70 years (age nearest birthday).

- In case a member is covered through more than one account and premium is received by the Insurance Company inadvertently, insurance cover will be restricted to one bank account only and the premium paid for duplicate insurance(s) shall be liable to be forfeited.

- If the insurance cover is ceased due to any technical reasons such as the insufficient balance on the due date or due to any administrative issues, the same can be reinstated on receipt of the full annual premium, subject to conditions that may be laid down. During this period, the risk cover will be suspended and reinstatement of risk cover will be at the sole discretion of the Insurance Company.

- Participating banks will deduct the premium amount in the same month when the auto-debit option is given, preferably in May of every year, and remit the amount due to the Insurance Company in that month itself.

Download Pradhan Mantri Suraksha Bima Yojana (PMSBY) Form

Please wait while flipbook is loading. For more related info, FAQs and issues please refer to DearFlip WordPress Flipbook Plugin Help documentation.

{Step by Step Guide} How to Apply for PMSBY

- Visit the Official Website Pradhan Mantri Suraksha Bima Yojana i.e. https://www.jansuraksha.gov.in/.

- On the Homepage Click on the “FORM” option under the menu section.

- The application form page will be displayed on the screen then download the form in your required language.

- Print the Application Form and Now fill in all the required details (Mention all the details such as name, father/ husband name, date of birth, gender, and other information) and attach documents.

- Visit the nearest Bank Office or your connected bank branch office and submit your application form.

Pradhan Mantri Suraksha Bima Yojana (PMSBY) Important Links

| Detailed Notification | Download Here |

| PMSBY Forms | Download Here |

| Official Website | Click Here |

Pradhan Mantri Suraksha Bima Yojana (PMSBY) Contact Details & Helpline No

We have provided all the details related to Pradhan Mantri Suraksha Bima Yojana. If you have faced any issues while applying for Pradhan Mantri Suraksha Bima Yojana, Kindly note below contact details for any help.

- National Toll-Free – 1800-180-1111 / 1800-110-001

- Click Here for State Wise Toll-Free Number.

Pradhan Mantri Suraksha Bima Yojana (PMSBY) FAQs

Can eligible individuals who fail to join the PMSBY Scheme in the initial year join in subsequent years?

Yes, on payment of premium through auto-debit. New eligible entrants in future years can also join the PMSBY accordingly.

Can individuals who leave the Pradhan Mantri Suraksha Bima Yojana rejoin?

Individuals who exit the Pradhan Mantri Suraksha Bima Yojana at any point may re-join the scheme in future years by paying the annual premium, subject to conditions that may be laid down.

Who would be the Master policyholder for the PMSBY?

Participating Banks will be the Master policyholders for the PMSBY. A simple and subscriber friendly administration & claim settlement process has been finalized by PSGICs /chosen insurance company in consultation with the participating bank.

Can all holders of a joint bank account join the Pradhan Mantri Suraksha Bima Yojana through the said account?

In case of a joint account, all holders of the said account can join the Pradhan Mantri Suraksha Bima Scheme.

Which Bank Accounts are eligible for subscribing to PMSBY?

All bank account holders other than institutional account holders are eligible for subscribing to PMSBY scheme.

What benefit will be payable under the Pradhan Mantri Suraksha Bima Scheme if a person suffers partial disability without irrecoverable loss of sight of one eye or loss of use of one hand or foot?

No benefit will be payable under the Pradhan Mantri Suraksha Bima Scheme if a person suffers partial disability without irrecoverable loss of sight of one eye or loss of use of one hand or foot.

Can an Account holder get claim under the Pradhan Mantri Suraksha Bima Scheme from more than one bank where he has enrolled and premium has been debited?

No. The insured/ Nominee shall be eligible for one claim only under the Pradhan Mantri Suraksha Bima Scheme.